GWG L-Bond Investments Are Nearly Worthless. Here’s How It Happened.

It Is Virtually Impossible That GWG L-Bond Investors Will Get What They Were Owed

As most L-Bond holders know, GWG entered “Chapter 11 bankruptcy” in 2021. That means GWG admitted that it would probably not be able to pay its debts.

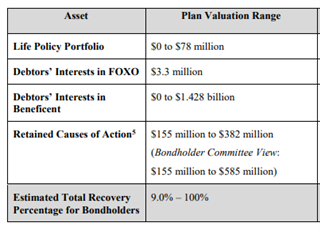

The bankruptcy allowed GWG to “restructure” its debts to L-Bond holders. As a result, GWG is no longer promising to pay L-Bond investors their initial investments back, let alone any interest. As a sort of consolation prize, GWG gave L-Bond investors rights to other assets (in particular, L-Bond investors are entitled to the value of those assets up to the point where the L-Bond investors receive back what they’re owed). GWG summarized the assets it gave to L-Bond investors in the following table:

GWG’s “Summary” was meant to give some hope to Bondholders: its bottom line says that Bondholders could recover up to 100% of what they were owed (although it concedes they could also recover as little as 9%).

The chart estimates that L-Bond investors could expect to receive up to $1.428 billion from their “interests in Beneficient” (Beneficient, which I’ll call “BEN,” is a small startup company that I’ll discuss in more detail in the next section of this blog post). But as of January 3, 2025, L-Bond investors’ interests in BEN are worth less than $125 million.

I am not merely speculating that L-Bond investors’ interests in BEN are worth less than $125 million. It is indisputable. That is because after GWG published the chart above, BEN became a publicly traded company. As a result, BEN’s value can easily be measured by its stock’s trading price.

You can track BEN’s value yourself by googling its stock ticker, “BENF.” L-Bond investors’ interests in BEN are worth less than the BENF current stock price (which, as of 1/3/2025, is $0.72) multiplied by 170 million (because L-bond investors have fewer than 170 million shares).

Given that L-Bond investors’ interests in BEN are worth less than $125 million, some simple arithmetic shown below demonstrates that L-Bond holders will probably get back only a small fraction of what they were owed.

Specifically, L-Bond holders are collectively owed $1.6 billion. The chart above shows that they would likely be paid what they are owed if their interests in BEN were worth $1.428 billion. Their interests in BEN are actually only worth less than $0.125 billion, which creates a $1.40 billion shortfall. That shortfall alone is more than 90 percent of what L-Bond investors were owed, which is a very bad sign for L-Bond investors.

Moreover, the chart above estimates that L-Bond holders’ ownership interests in the “Life Policy Portfolio” (that is, the life insurance policies that GWG purchased while it was operating) was up to $78 million. But after the chart was published, the trustee sold the life insurance portfolio for approximately $10 million.

Furthermore, the judge in the bankruptcy case stated about GWG L-Bonds, in October of 2023, that he believed that L Bondholders would lose a very large percentage of their investments.

The rest of this blog post describes the history of GWG L-Bonds to attempt to explain why brokers knew or should have known that it was inevitable that L-Bondholders would lose money.

GWG’s Original Business Was Raising Money With L-Bonds And Investing In Life Insurance Policies

For most of its existence, GWG invested in life insurance policies. Specifically, if a person held a life insurance policy and needed money immediately, he or she could sell the life insurance policy to GWG for a lump-sum payment. GWG then paid premiums on that life insurance policy until the person died, at which time GWG could collect the death benefit.

GWG raised money for its business mostly by selling L-bonds to retail investors. L-bonds, like other bonds, were like an “IOU.” That is, the L-Bond investor agreed to loan money to GWG, and in exchange, GWG agreed to pay the investor interest every year before returning the investor’s principal after a set number of years.

Since They Were First Issued In 2012, L-Bonds Have Been Very Risky And Illiquid

GWG began selling what it called “Renewable Secured Debentures” (which it would later re-name “L-Bonds”) in 2012. From the beginning, they were very risk and illiquid securities. Their offering documents even admitted that they may be considered “speculative” and “high risk.”

As explained in more detail under the next header, the main reason that L-Bonds/debentures were very risky and speculative is because GWG itself was always a failing business that never made a profit.

However, separate and apart from GWG’s shortcomings as a company, L-Bonds had very risky characteristics as a financial instrument. First, unlike most public reporting securities, L-Bonds were illiquid. That means they did not trade on any public market, so there was no public trading price to track their value. Unfortunately, many broker-dealers told investors took advantage of GWG’s lack of a transparent public trading price by telling retail-investors, falsely, that an L-Bond’s value was stable and unchanging. The reality was that an L-Bond’s value was often declining in value; the decline was just invisible because of the lack of a trading price.

Another risky characteristic of an L-Bond was that they were not directly secured by the life insurance policies that constituted a majority of GWG’s assets. GWG’s life insurance policies had been pledged as collateral for a different line of credit used by GWG. Therefore, in the event GWG defaulted on the L-Bonds (as, of course, it eventually did), L-Bond holders would not have necessarily be able to get their money back by liquidating GWG’s assets. GWG’s other creditors would have the first-priority claims.

Because of L-Bonds/debentures’ risky and speculative nature, FINRA disciplined broker-dealers who sold these high-risk securities to elderly or conservative investors, even if the broker-dealers disclosed the risks.

GWG Was Doomed Because It Omitted Key Costs From Its Financial Projections And Paid Enormous Commissions To L-Bond Sellers

From the beginning of its existence, GWG inflated its own profitability projections by omitting key costs from those projections. In fact, the only costs GWG included in its projections were the acquisition cost of the policies and premium payments.

In other words, GWG assumed it would pay zero dollars for basic expenses like operating expenses and financing costs. That was obviously not a realistic assumption.

Not only did GWG understate its expected costs, but it also overstated the revenue it could expect to collect from its life insurance policies maturing. GWG even admitted that it had overstated its expected revenue in its 2018 Form 10-K. In particular, GWG cited unreliable mortality studies (rather than standard life-expectancy tables), which allowed GWG to underestimate the life expectancy of the people its life-insurance policies were tied to, which inflated GWG’s expected revenue.

Because GWG vastly understated its projected costs and overstated its expected revenue, it is not surprising that GWG lost money every year. By the end of 2018, GWG was $300 million insolvent.

To make matters worse, selling the L Bond—GWG’s primary source of cash for acquiring additional life insurance policies (and paying premiums on existing policies)—became exceedingly expensive for GWG. Indeed, after April 2018, GWG paid its top 12 broker-dealers more than $42 million in commissions alone to sell L-bonds.

Those enormous commissions paid to brokers, which sometimes reached an astonishing 8 percent of the price of the sold L-Bonds, harmed retail investors in two ways. First, as discussed above, the high commissions were a large cost for GWG that lead to its insolvency. Second, the commissions gave perverse incentives to brokers to sell L-Bonds to investors even though it was not in the investors’ interests.

GWG L-Bonds Were A Ponzi Scheme

GWG was a Ponzi scheme, meaning that it continued a cycle of (1) borrowing money by selling L-Bonds; (2) losing the borrowed money in its failed business operations; and then (3) borrowing more money to pay back its bondholders. Every time this cycle repeated itself, GWG had to borrow more money, and the cycle was bound to collapse.

The more L-Bonds GWG sold, the more cash it needed to make interest and maturity payments on L-Bonds. Because GWG’s life insurance portfolio failed to generate enough cash to even cover the servicing costs of L-Bonds, GWG opted to double-down and simply sell more L-Bonds. Therefore, GWG incurred more and more debt, just to pay its old investors and avoid defaulting on its existing obligations.

That is how L-Bonds became a classic Ponzi scheme in which new L-Bonds needed to be sold in order to generate proceeds to pay the interest and principal obligations on existing L-Bonds.

Notably, GWG admitted, even in its early L-Bond/debenture offering documents that it was relying on future L-Bond sales to pay back current L-Bond investors.

Because GWG’s existence depended on its ability to keep selling L-Bonds, GWG went to great lengths to sell the L-Bonds, including misleading L-Bond purchasers. For example, according to FINRA enforcement, some GWG-created sales kits included brochures that inaccurately implied that L-Bonds/debentures were secured by $489 million of life insurance policies. The reality was that, as discussed above, life insurance policies had actually been pledged to secure other GWG creditors’ loans. Moreover, the $489 million value was the face value of the benefits of the policies and not their current value, a significantly lower number.

Brad Heppner And His Startup Beneficent Took Over The GWG L-Bonds Ponzi Scheme

Brad Heppner owned BEN, which was a highly speculative startup. BEN focused on a supposedly untapped market: offering liquidity solutions to wealthy individuals and institutions holding illiquid assets. However, BEN’s theoretical business model faced a number of challenges, including whether this market even existed.

Moreover, all BEN had was this untested idea. It lacked what GWG had to offer: a ready stream of cash.

Heppner/BEN wanted to co-opt GWG’s L-Bonds Ponzi-scheme so that BEN would have a source of cash flow. So that’s what they did. Beginning in January of 2018, Heppner and BEN took over GWG in a series of illegal insider transactions.

It is indisputable that BEN did not pay GWG fair compensation for acquiring GWG interests. Instead, BEN insiders (mostly Heppner) benefitted at the expense of GWG stakeholders like L-Bond investors. The insiders attempted to cover up GWG’s illegal acquisition of GWG by overstating BEN’s value (in particular, they overstated BEN’s “goodwill,” meaning its intangible value).

Then, beginning in June 2019, Heppner and BEN used their unlawfully acquired control over GWG to re-direct GWG’s L-Bonds proceeds away from purchasing life insurance and towards funding Ben’s unproven operations.

Actually, Heppner and BEN didn’t just redirect the proceeds to Ben’s operations. Shortly after Heppner and BEN began re-directing GWG’s L-Bonds proceeds to Heppner/Ben, Tiffany Kice, Beneficient’s chief financial officer, discovered that millions of dollars were being redirected into Heppner’s pocket.

For example, Heppner used the L-Bonds proceeds to “pay himself back” for his own investments he had made in the company to make sure he wouldn’t lose money if BEN failed. According to the Wall Street Journal, BEN also used L-Bond proceeds to pay Heppner for “ranch-related business activities,” which were later listed as “discontinued operations.” The “ranch activities” appeared to be used almost entirely for the benefit of Heppner’s family, friends, and business associates.

The Wall Street Journal also reported that BEN paid Heppner over $20 million to purchase a technology company that owned assets more than a decade old, and the technology company’s assets were soon written off.

As an aside, many people who were sold L-Bonds after 2018 did not even realize that they were investing in BEN. For example, the SEC charged a brokerage firm with violating Regulation Best Interest partly because its brokers sold L-Bonds in 2020 without any awareness of Ben.

If a brokerage firm sold an investor L-Bond after 2018 (or renewed an L-Bond an investor had previously purchased) and neglected to tell the investor that L Bonds were investing in Ben, then the brokerage firm probably committed fraud.

The L-Bonds Ponzi Scheme Collapsed After Auditors And Board Members Resigned, And The SEC Began Investigating GWG

GWG/BEN tried to cover up their L-Bonds Ponzi scheme, and BEN’s illegal acquisition of GWG, with accounting shenanigans. For example, as noted above, they overstated BEN’s “goodwill.” Moreover, according to the Wall Street Journal, BEN made loans to its own subsidiaries and counted the interest and fees it got back as revenue, which created the false appearance that BEN was generating revenue growth when in fact BEN’s assets were actually incurring losses.

Those accounting shenanigans created the false appearance that (1) GWG/BEN had enough assets to pay back L-Bond holders, and (2) BEN had paid a fair value (and thus legally acquired) GWG.

The accounting shenanigans became so bad that, after 2018, all of GWG’s auditors resigned or declined to seek reappointment after less than a year. So, it is not surprising that GWG failed to timely file its 2020 annual report and its quarterly report for the first quarter of 2021.

Moreover, in August of 2019, three GWG Board members raised concerns to GWG management about GWG and its relationship with BEN. When Heppner, Ben, and the rest of GWG refused to address those concerns, all three of the Directors resigned their positions in October 2019.

In March 2020, BEN added Murray Devine to a “Special Committee” on GWG’s Board that was supposed to be composed solely of Directors that were not affiliated with BEN. BEN falsely stated that Devine was “disinterested and independent” from BEN. That was obviously false; Devine was on the Board of Ben.

Incredibly, broker-dealers continued to sell L-Bonds despite all these red flags.

The Securities and Exchange Commission, however, commenced an investigation. Once the investigation became public, GWG could no longer sell new L-Bonds to pay back existing L-Bondholders. The Ponzi scheme, therefore, collapsed.

Many Brokerage Firms That Sold GWG L-Bonds Have Exhausted Their Assets Paying Claims Brought By GWG L-Bond Holders

Many L-Bond purchasers have sued the broker-dealer firms that sold them GWG L-Bonds. The claims have largely been successful.

For example, Banks Law Office’s attorney Nico Banks represented GWG L-Bond purchasers and won a $1.3 million FINRA arbitration award against Larry Richard Law, the former owner of JRL Capital Corporation (a now defunct entity).

In fact, the claims have been so successful that they have forced many GWG L-Bond sellers into bankruptcy or otherwise out of business. JRL Capital Corporation was one of those entities. Emerson Equities may be another now that it has exhausted its insurance policy related to GWG L-Bonds

Because these claims are forcing broker-dealers into bankruptcy, it is important that GWG L-Bond investors bring claims against broker-dealers soon.

FINRA Takes Action Against Sellers Of GWG L-Bonds In 2024

FINRA has disciplined several entities and individuals who were responsible for selling GWG L-Bonds.

For example, in November of 2024, FINRA issued a letter of acceptance, waiver, and consent (“AWC”) alleging that Blaine R. Stahlman, a General Securities Principal, failed to supervise his subordinates’ sales of GWG L-Bonds. Stahlman was the founder, CEO, and Chief Compliance Office of Professional Broker-Dealer Financial Planning, Inc. (“PBD”).

FINRA found that the sales of L-Bonds at issue violated Regulation Best Interest because purchasing L-Bonds was not in the customer’s best interests. The L-Bonds represented between 11 percent and 32 percent of the customers’ net worth, and three of the customers were seniors.

Likewise, in November of 2024, FINRA issued another AWC in which it found that Linda Wimsatt violated regulation best interest by recommending that investors invest more than 10% of their net worth in GWG L-Bonds, particularly when the investors had only moderate risk tolerances.

In August of 2024, FINRA issued another AWC in which it found that Kyle Chapman violated regulation best interest by failing to conduct a reasonable review of the GWG L-Bonds offering documents and failing to understand the risks related to L-Bonds before selling them to his clients. For example, Chapman failed to understand that, in the event GWG defaulted, bondholders’ ability to enforce their rights to payment would be restricted. Likewise, Chapman failed to understand that the “diversification” caused by GWG’s change in business model in 2018 and 2019 would reduce the risks associated with the investment. The AWC stated that “this change in business model increased the risks associated with investment in GWG L Bonds, in part because L Bonds were no longer fully backed by life insurance policies.”

If You Invested In GWG L-Bonds, You Should Contact An Attorney

Your best option to recover your investment in L-Bonds is probably to hire an attorney to represent you on a contingency fee basis. A “contingency fee” means that you will never pay anything out of pocket for their services. The attorney will just keep a percentage of what they can recover for you.

The attorneys at Banks Law Office have experience representing investors in GWG L-Bonds. Please contact us at 971-678-0036 or info@bankslawoffice.com.