Altman’s Z Score Shows GWG’s High Risk Of Bankruptcy In 2018

We’ve previously written about the downfall of GWG L-Bonds. We also previously wrote about how we know GWG L-Bond investors have already lost most of their investment.

In this blog post, we’ll explore a simple formula called the “Altman Z-Score,” which shows how anybody could have (and should have) known that GWG L-Bonds were extremely risky investments and unsuitable for retail investors.

Bondholders Generally Don’t Lose Their Investments Unless The Company Becomes Insolvent

Most investors understand that, all else equal, bonds are safer investments than equity investments. That is because, generally, if a company gets into financial trouble, its bond investors must be paid what they’re owed before equity investors can be paid anything. In fact, if a company fails to pay its bondholders (that is, if the company “defaults” on its debt), the bondholders can often force the company into bankruptcy to collect what they’re owed.

Therefore, the only risk for bondholders, generally, is that the company gets into financial trouble so bad that its equity holders lose their entire investments, and even after the company is forced into bankruptcy and sells all its assets, the company still can’t pay fully pay its bondholders what they’re owed. Put differently, so long as a company’s assets are worth more than its debts, bondholders should not lose their investment.

When a company is in financial trouble so bad that it would be unable to pay back its bondholders even after selling all of its assets—that is, when the company’s liabilities become greater than the value of the company’s assets—the company is “insolvent,” and bondholders may lose their investments.

In summary, bonds are generally safe investments because bondholders can only lose money if the company becomes insolvent.

GWG Had A Very High Risk Of Insolvency

GWG L-Bonds were, of course, bonds. But wait, we just said bonds are safe, right?

Not quite. It’s true that GWG L-Bonds were safer than investments in GWG equity. But, GWG’s risk of insolvency (that is, the risk that its assets were, or would be, worth less than its outstanding debt) was so high that even the bonds were extraordinarily risky.

How can we tell that GWG’s risk of insolvency was so high?

Meet the “Altman Z-Score” — the gold standard for measuring a company’s risk of insolvency and predicting whether a company will declare bankruptcy within the next year. When Altman’s Z-Score predicts that a company will declare bankruptcy, it is wrong less than 7% of the time.

The Altman Z Score was developed by Edward Altman in 1968 and is widely used by investors, analysts, and creditors as a predictor of a company’s likelihood of going bankrupt within the next two years. The Z-score is particularly useful for evaluating the financial stability of publicly traded firms.

The Altman Z-score is calculated using a formula that combines several financial ratios called a “Z score.” The higher the z-score, the lower the risk of insolvency. When measuring non-manufacturing firms (like GWG), the formula consists of four financial ratios, each assigned a specific weight:

Z = 6.56 × X1 + 3.26 × X2 + 6.72 × X3 + 1.05 × X4

Where:

- X1 represents the working capital/total assets ratio, which is a measure of the company’s ability to pay its short-term debts. “Working capital” is the amount of assets that the firm has that will be converted into cash in the next year (e.g., accounts receivable or inventory) minus the amount of liabilities that the firm will need to pay off in the next year (e.g., accounts payable, or short-term debt). In shorthand, “working capital” is “current assets minus current liabilities.” Note that a firm could become insolvent if it doesn’t have enough current assets to pay its current liabilities, which is why a higher working capital/total assets ratio leads to a higher z-score (which is to say, a lower risk of insolvency).

- X2 represents retained earnings/total assets. Retained earnings is the account that reports the total amount of earnings a firm has reinvested in itself (rather than paid out as dividends to shareholders or lost in subsequent operations). A higher ratio indicates that the firm generates more available cash through its own operations, which makes it less likely that the firm will become insolvent. Low retained earnings indicate that the firm may be relying on borrowing money—rather than its own profitability—to pay off debt, which increases the risk of insolvency.

- X3 represents earnings before interest and taxes (EBIT)/total assets. “Earnings before interest and taxes” is a standard measure of a firm’s gross profits from its operations. Again, a higher ratio indicates that the firm is more profitable, so it is less likely to become insolvent.

- X4 represents book value of equity/book value of total liabilities. This is a measure of a firm’s “leverage.” If the firm has a lot of equity, then it is less likely that the firm would become insolvent because, as discussed above, bondholders generally don’t lose their investments until the firm’s equity becomes worthless (because bondholders must be paid before equity holders can be paid). So long as the equity is valuable, the bondholders have a cushion, and the risk of insolvency is lower.

The Z-score provides a single numerical value that is interpreted as follows:

- A Z-score above 3 indicates a healthy and financially stable company.

- A Z-score between 1.8 and 3 suggests a company is in a gray zone and needs monitoring.

- A Z-score below 1.8 indicates a high risk of financial distress or bankruptcy.

Let’s calculate the Z-score of GWG L-Bonds as of the end of 2017 to try to discern its risk of insolvency.

GWG’s Working Capital / Total Assets Ratio

First, we need to calculate the working capital/total assets ratio.

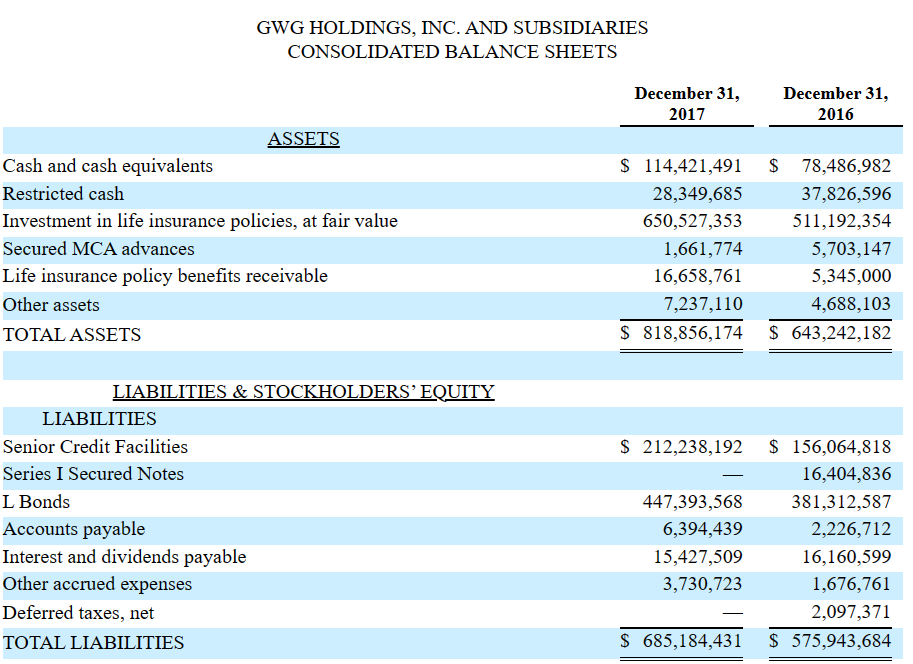

We can calculate GWG’s working capital by looking at its balance, sheet, which is shown below:

As discussed above, a company’s working capital is its current assets (that is, the assets that will be converted into cash within the next year) minus its current liabilities (that is, the debts that the company will need to pay within the next year).

Looking at the balance sheet, GWG’s current assets should approximately equal its cash, restricted cash, and life insurance policy benefits receivable. Those assets would likely be converted into cash within the next year, whereas its other assets would likely not be converted into cash until later. The total of those current assets is $159,429,937.

GWG’s current liabilities should include its accounts payable, the interest and dividends payable, which equals $21,821,948.

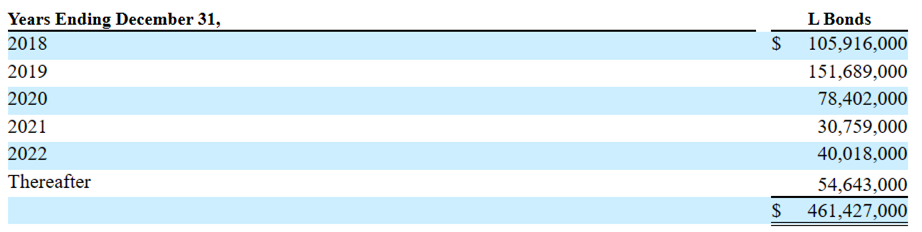

However, GWG’s current liabilities also include part of the “L Bonds” – namely, the L Bonds for which the principal would need to be returned within the next year. As shown in the table below from GWG’s 2018 10-K, the L-Bonds that would need to be paid within the next year (that is, in 2018) are $105,916,000.

Therefore, GWG’s working capital—its current assets minus all its current liabilities—equal $31,691,989 (the math is $159,429,937 – $21,821,948 – $105,916,000).

Looking at the balance sheet above, GWG’s total assets are $818,356,174.

So, GWG’s working capital / total assets ratio is $31,691,989 / $818,356,174,or 0.0384.

GWG’s Retained Earnings / Total Assets Ratio

The next step in Altman’s Z-Score formula is calculating GWG’s retained earnings / total assets ratio.

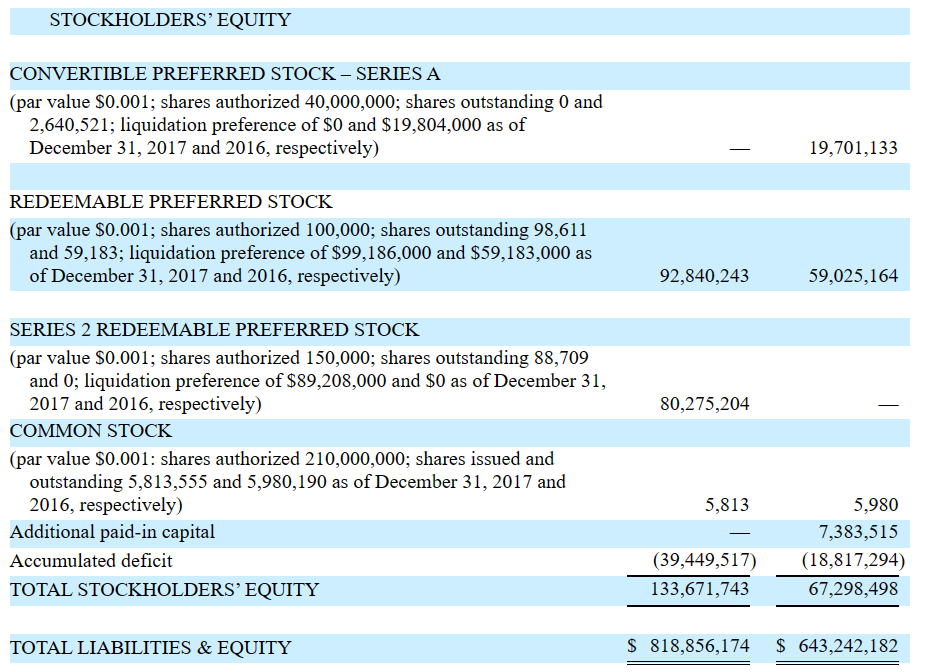

The part of GWG’s balance sheet shown below shows that GWG has negative retained earnings (which it calls “accumulated deficit”) of -$39,449,517, which means that it has lost assets from its operations (rather than retained any earnings) because it has not been profitable.

So, GWG’s retained earnings / total assets ratio is -0.0482.

GWG’s EBIT / Total Assets Ratio

Next, we calculate GWG’s EBIT / Total Assets Ratio.

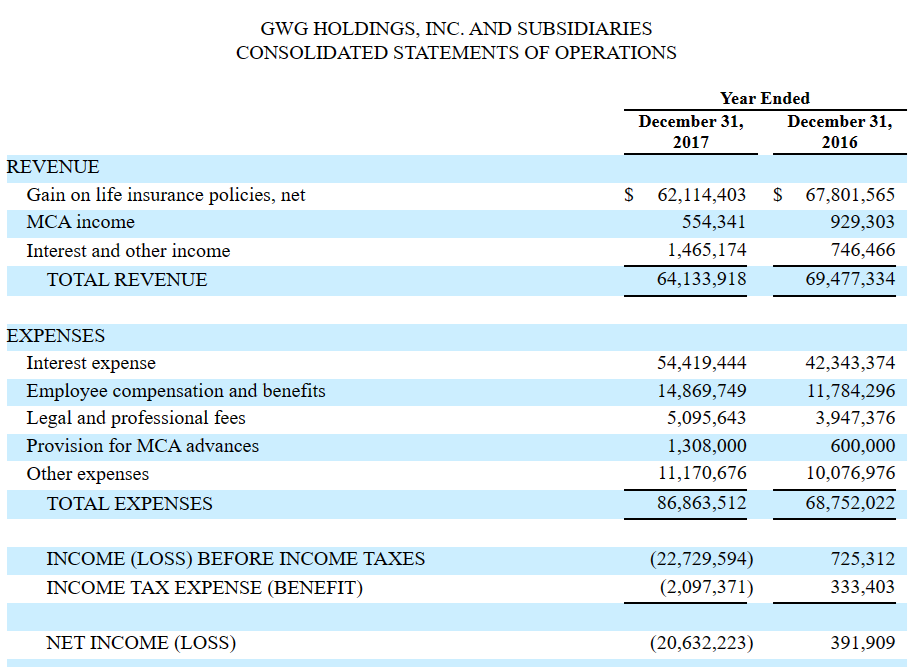

Recall that “EBIT” is “earnings before interest and taxes. GWG’s income statement, which calculates its earnings, is shown below:

As shown on the income statement, GWG’s total earnings—that is, its earnings after interest and taxes—is -$20,632,223. That is, GWG lost money in 2017 (as an aside, GWG lost money every year it existed). To find GWG’s earnings before interest and taxes, we can simply add back the interest expense ($54,419,444) and take out the tax benefit (-$2,097,371). That leaves an EBIT of $31,689,850.

Therefore, GWG’s EBIT/Total Assets ratio is 0.0387.

GWG’s Book Value of Equity / Total Liabilities Ratio

Next, we calculate the book value of equity / total liabilities ratio.

The total book value of equity and total liabilities are both shown on the balance sheet above. The book value of the equity is $133,671,743, and the total liabilities are $685,184,431.

Therefore, the book value of equity / total liabilities ratio is 0.195.

Calculating And Interpreting GWG’s Z Score

As noted above, we calculate Altman’s Z Score for non-manufacturing firms like GWG using the following formula.

Z = 6.56 × X1 + 3.26 × X2 + 6.72 × X3 + 1.05 × X4

So GWG’s Z score is as follows: 6.56 x 0.0387 + 3.26 x 0.0482 + 6.72 x 0.0387 + 1.05 x 0.195

The Z score ends up being 0.562.

So how do we interpret that Z Score?

According to Altman’s study, we should interpret the results as follows:

- The formula predicts that companies with Z Scores greater than 2.90 will not declare bankruptcy within the next year.

- The formula predicts that companies with Z Scores between 1.21 and 2.90 are in a “grey area,” meaning it’s difficult to predict whether they will declare bankruptcy within the next year.

- The formula predicts that companies with Z scores lower than 1.21 will declare bankruptcy within the next year.

Incredibly, when the formula predicted that a company would go bankrupt, it was correct more than 96% of the time. And since GWG had a Z score significantly less than 1.21, the Z score easily predicted that GWG would go bankrupt within the next year.

As a disclaimer, some have suggested that Altman’s Z score may be less accurate for financial services companies because Altman’s study did not include such firms. However, many studies have concluded that, in fact, Altman’s Z Score and similar factor models are valid predictors for both large companies and financial services companies.